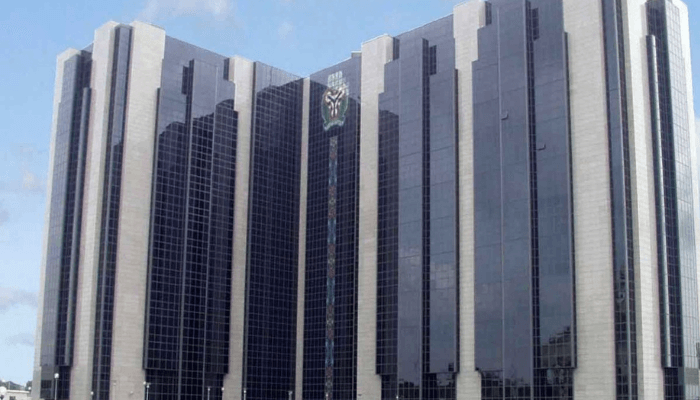

The Central Bank of Nigeria has asked those involved in foreign exchange transactions to submit documents that comply with Nigeria’s foreign exchange regulations by January 31, 2025.

The guidelines are part of its efforts to promote ethics, governance and transparency in business.

The Nigeria FX Code, which became effective on December 2, 2024, sets out principles of good practice to ensure a robust, fair, and transparent foreign exchange market.

It applies to authorised dealers licensed under the CBN Act of 2007, the Bank and Other Financial Institutions Act of 2020, and other entities engaged in wholesale FX business in Nigeria.

- Advertisement -

In addition, minutes of board meetings must be provided to demonstrate oversight and accountability.

The Forex Code document published on Monday stated: “Market participants must conduct a company-level self-assessment under Forex regulations and submit a report to the central bank by January 31, 2025.”

“Thereafter, all participants in the transaction must submit to the central bank a detailed declaration of compliance with the agreement and signed by the central bank.” “The bank, together with the withdrawals from the board of directors.”

After the January 31 deadline, market participants are required to submit quarterly compliance reports to the financial institution in the financial sector.

These reports are expected to be submitted within 14 days of the end of each quarter, with the first report due by March 31, 2025.

- Advertisement -

The central bank has introduced regulatory measures to ensure compliance, including penalties under the Central Bank Act 2007 and the BOFIA Act 2020. These measures aim to prevent illegal practices and ensure the integrity of foreign trade.

Nigerian FX regulations are modelled on international FX regulations to address the specifics of the Nigerian FX market while also incorporating global best practices. The policy covers key issues such as ethics, governance, enforcement, information sharing, risk management and problem-solving processes.