The Kenyan Parliament has rejected a proposal to grant the country’s revenue authority unrestricted access to tax payers’ data, citing privacy and constitutional concerns.

The new proposal is part of the new finance bill which the Finance Minister John Mbadi has defended saying it would help curb tax evasion, particularly by wealthy individuals exploiting legal protections to conceal financial information.

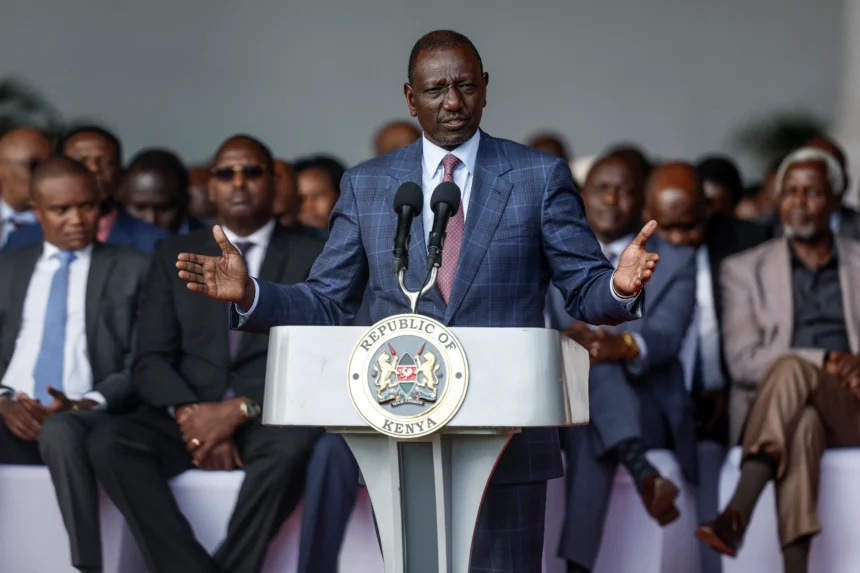

Since assuming office in 2022, President William Ruto has been trying to increase tax collection to shore up revenue while boosting debt repayment plans. To achieve this, he came up with the controversial Finance bill which generated widespread protests and riots.

In response, the government withdrew the bill and introduced a revised version which aims to raise an extra 30 billion shillings ($233 million), mainly through boosting tax compliance.

- Advertisement -

The provision seeking full data access is deemed necessary as the government aims to collect relevant financial information from businesses and individuals, to help detect any form of tax evasion or avoidance.

However, members of the Parliament’s finance committee are opposed to the provision, noting that current laws already allow the Kenya Revenue Authority (KRA) to access financial data with a court warrant, making the proposal unnecessary.