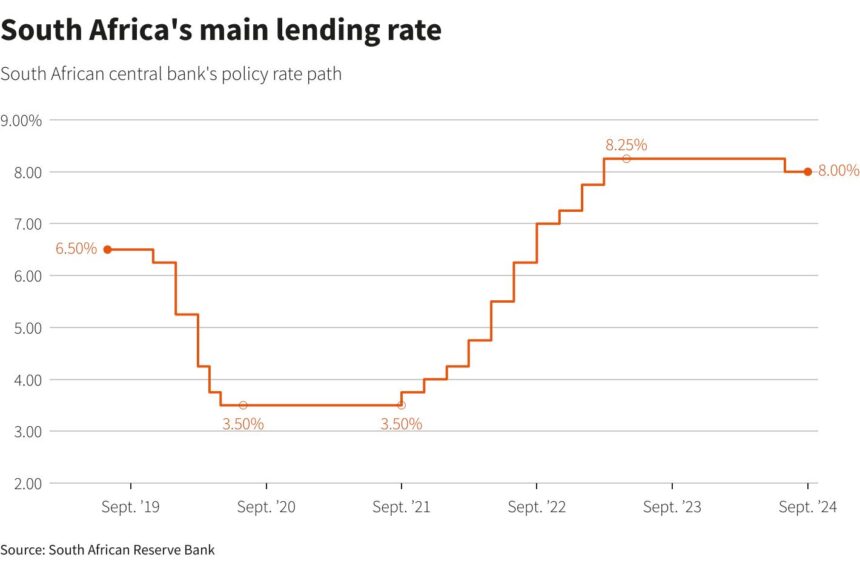

The South African Reserve Bank (SARB) has lowered its benchmark interest rate by 25 basis points to 8%, marking the first rate cut since 2020.

This decision follows the U.S. Federal Reserve’s 50 basis-point reduction and reflects growing momentum for global monetary easing.

The rate cut comes as inflation in South Africa has moderated, falling below the midpoint of the central bank’s target range of 4.5%.

With inflation cooling and a stable rand, South Africa joins other central banks in reducing borrowing costs, potentially bolstering investor confidence in emerging markets and leading to more favorable financial conditions and capital inflows.

- Advertisement -

Governor Lesetja Kganyago announced the decision during a press briefing on Thursday, citing projections of lower inflationary pressures in the medium term.

Most analysts have predicted the rate cut, even before the statement from the top bank. Economists expect further rate cuts, potentially reaching 7.25% by May 2025, as inflation is predicted to average 4.7% in 2024 and decline to 4.3% in 2025.

The inflation slowdown has been driven by decreased transport prices and utility rates, with annual inflation averaging 5.9% in 2023 and 6.9% in 2022. However, South Africa’s economy grew by only 0.4% in H2 2024, highlighting the need to boost growth.

Analysts see the rate cut as a welcome financial reprieve, supportive for consumers under strain, and potentially positive for GDP growth outcomes.

The Democratic Alliance noted that while there are early signs of confidence in the economy, significant reforms are still required to achieve substantive growth.

- Advertisement -

Some economists contend that the bank should make large rate cuts of about 50 basis points rather than making incremental reductions which may not provide a meaningful boost to economic activity.

SARB’s MPC is expected to announce its next rate decision on 21 November 2024.