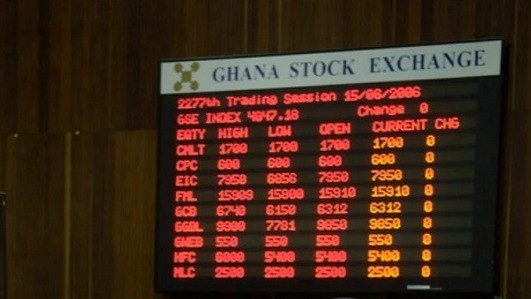

The Ghana Stock Exchange (GSE) has emerged as West Africa’s top-performing market in the first quarter of 2025, recording a 30% gain in its main index. The financial stock index alone rose by 33%, driven by increased investor confidence and heightened trading activity.

Managing Director Abena Amoah attributes the impressive performance to improving macroeconomic conditions and growing participation on the exchange.

As of May 18, the GSE’s market capitalization reached GH¢143 billion, representing a 70% year-on-year increase. Fixed income market activity has also surged, with traded volumes rising 53% to GH¢87 billion compared to the same period last year. These indicators show a broader trend of investor optimism in Ghana’s economic recovery, positioning the GSE favorably among its regional peers.

One of the most significant developments is the announcement from Kasapreko PLC, Ghana’s leading indigenous beverage company. During the GSE’s “Facts Behind the Figures” forum, Kasapreko CEO Richard Adjei revealed plans to list 25% of the company’s equity shares on the GSE main board by the end of 2025.

- Advertisement -

The move follows the company’s strong financial results, with revenue reaching GH¢2.7 billion in 2024—a 45% increase driven by both domestic and export sales. In Q1 2025, the company has already posted a 52% revenue rise and a 184% increase in profit after tax.

Richard Adjei said, “Thanks to the board and the investors, we have received approval to list equities on the main market. Thanks to the Ghana Stock Exchange for pushing us to achieve this and also to our arrangers, we believe that we have to get more shareholders so we can take advantage of bigger markets.”

Abena Amoah praised Kasapreko’s trajectory as a powerful example of local business success and encouraged investors to support its upcoming equity offering. She emphasized that such listings not only enhance corporate visibility and capital access but also deepen the exchange’s role in national development.