Investing in Africa presents numerous opportunities for both seasoned and novice investors. The continent, often overlooked in favour of more developed markets, is experiencing a surge in economic prospects, partially attributed to political stability, accelerating GDP growth, improved infrastructure, and investor-friendly policies.

Rwanda

Characterised as one of the most striking success stories in Africa. The government has focused on economic reforms and anti-corruption measures, boosting investor confidence. Rwanda’s GDP growth, consistently hovering around 7. 5 cent annually, showcases its burgeoning middle class and increasing consumer demand. Infrastructure improvements, particularly in Kigali, are evident, as the government invests heavily in road construction and energy generation. Policies that simplify business registration and taxation enhance the country’s attractiveness to foreign investor.

Ethiopia

Ethiopia has been on an impressive growth trajectory, with double-digit GDP growth rates in the past decade. While the nation faces challenges, including political unrest, the government has been proactive in consolidating stability. Ethiopia has focused on industrial growth through its Developmental State model, which prioritises infrastructure development, particularly in power and transport. Significant investment in the Grand Ethiopian Renaissance Dam further solidifies its energy sector, positioning the nation as a potential leader in energy production in the region. Coupled with an extensive agricultural base, Ethiopia remains an attractive destination for foreign investment.

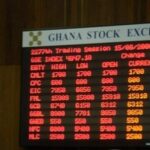

Ghana

Ghana serves as the third contender on this list. It has maintained a stable political climate and is known for its democratic governance since the early 1990s. Ghana’s economic growth, averaging around 6. 5 cent, is driven by robust sectors such as gold mining, cocoa, and oil. The country’s strategic reforms, including the Ghana Investment Promotion Centre Act, which attracts foreign direct investment, are vital in supporting business operations and ensuring investor protection. The government’s Vision 2020 initiative emphasises infrastructure development, particularly roads and digital infrastructure, enhancing overall connectivity and accessibility for businesses.

- Advertisement -

Nigeria

Nigeria is the continent’s largest economy. Despite facing economic challenges, Nigeria’s youth population presents a significant opportunity for investment in consumer markets and technology. The country has experienced substantial GDP growth, spurred by diverse sectors such as telecommunications and agriculture. Political stability is improving, despite regional issues. Policies promoting ease of doing business and support for startups contribute positively to Nigeria’s investment climate. Furthermore, the government’s reliance on economic diversification mitigates risks associated with over-reliance on oil revenues.

Kenya

Kenya, as the fifth notable country, has emerged as an innovation hub in East Africa. Through advancements in technology and a vibrant startup ecosystem, particularly in Nairobi, the country has attracted significant investment. Political stability, reinforced by regular democratic elections, supports a conducive environment for business. With GDP growth averaging around 5. 5 cent, diverse sectors such as agriculture, finance, and tourism create expansive opportunities. The government’s adoption of the Big Four Agenda focuses on enhancing manufacturing and affordable housing, creating clear pathways for investors.

Botswana

Consistently ranks among Africa’s most stable and well-governed nations. The nation has demonstrated sound economic management, primarily focusing on diamond mining. Over the years, Botswana’s GDP growth has averaged 4. 5 cent, despite the fluctuating global diamond market. The government promotes an investor-friendly environment through tax incentives and a straightforward business registration process. Botswana’s commitment to diversifying its economy into tourism, agriculture, and financial services enhances its attractiveness to investors.

Senegal

In terms of innovation and growth, Senegal deserves mention as the seventh country. Its government has consistently pushed reforms aimed at improving business ease and investor experience. Senegal enjoys a stable political climate and has made strides in infrastructure projects, particularly through the Dakar-Diamniadio Toll Highway. With consistent GDP growth nearing 6 per cent, sectors such as agriculture, services, and mining are ripe for investment. The Plan Senegal Emergent highlights the country’s ambitious development strategy, enticing foreign capital.

Mauritius

Mauritius, the eighth contender, stands out due to its political stability and robust economy. The island nation remains one of Africa’s top destinations for foreign direct investment. With a rigorous legal framework and business-friendly policies, including comprehensive tax treaties, Mauritius attracts businesses wishing to access African markets. Recent initiatives to develop sectors such as technology and renewable energy indicate a forward-thinking approach that ensures sustainable growth while enhancing investor confidence.

- Advertisement -

Tanzania

Tanzania ranks ninth for its attractive investment climate characterised by political stability and GDP growth rates averaging close to 6 percent. The country benefits from various natural resources, including gold, gas, and agriculture. The government is pursuing substantial infrastructure investments, particularly in transport and energy, to bolster economic development. Tanzania’s commitment to investor protection and ease of doing business through regulatory reforms further enhances its attractiveness.

Ivory Coast

The Ivory Coast is witnessing rapid GDP growth, primarily driven by agriculture, particularly cocoa and cashew production. Political stability has been maintained since the end of civil unrest, which makes the Ivorian market increasingly secure for investors. The government’s ambitious National Development Plan aims to modernise infrastructure, attract foreign investment, and enhance economic competitiveness, evident in their continued agricultural and urban reforms.

In conclusion, these ten African countries illustrate the diverse investment opportunities available across the continent. Political stability, GDP growth, ongoing infrastructure developments, and investor-friendly policies are critical factors that shape these investment landscapes. As Africa continues to evolve, the potential for economic development remains immense. Investors should consider engaging with these markets, not just for profit, but to be a part of a transformative journey fueling growth and development across the African continent.