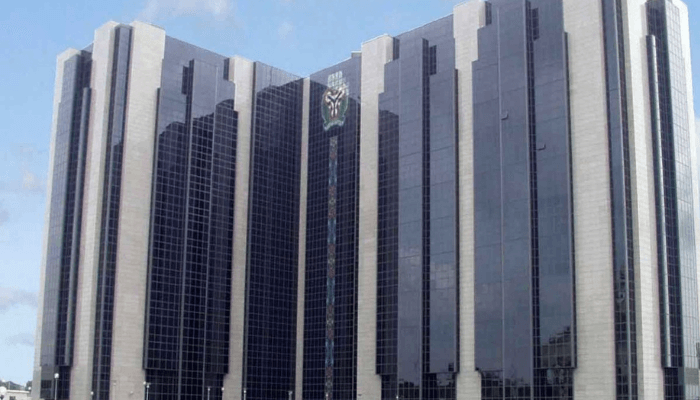

The Central Bank of Nigeria (CBN) has announced its forthcoming monetary policy committee (MPC) meeting.

The CBN disclosed in a notice on Tuesday that the meeting will be held on May 19 and 20 at its headquarters in Abuja.

The upcoming meeting marks the 300th session of the MPC, which is the CBN’s highest decision-making body on monetary policy, responsible for setting key economic parameters to maintain price stability, support economic growth, and safeguard the financial system.

The MPC comprises 12 members, including the CBN Governor, and operates under the CBN Act of 2007. Their primary task remains ensuring that Nigeria’s monetary policy aligns with macroeconomic goals of price stability, sustainable growth, and improved economic resilience.

- Advertisement -

Hence, the committee’s meetings are closely followed by financial analysts, investors, and policy stakeholders, as it’s decisions influence interest rates, inflation control measures, and currency management strategies.

As Nigeria continues to grapple with inflationary pressures and exchange rate volatility, this upcoming meeting is particularly important.

Recent reforms introduced under CBN Governor Olayemi Cardoso have aimed at restoring investor confidence and improving transparency in the country’s financial system. Cardoso has maintained a focus on orthodox monetary policies to tackle economic challenges.

At its last meeting in February 2025, the MPC kept the Monetary Policy Rate (MPR) steady at 27.5% in response to updated inflation figures from the National Bureau of Statistics (NBS), which showed a drop in the inflation rate to 24.48% from 34.8% after a revision of the Consumer Price Index. Other key policy tools, such as the Cash Reserve Ratio (CRR) at 50% and the Liquidity Ratio at 30%, were also left unchanged.

Analysts predict that the MPC may either maintain its current tight monetary stance or consider further rate hikes to manage persistent inflation and stabilize the naira. The outcome of this meeting will be crucial in shaping Nigeria’s economic direction in the coming months.