The Kenya Revenue Authority (KRA) has announced the development of a set of laws aimed at improving the country’s tax system.

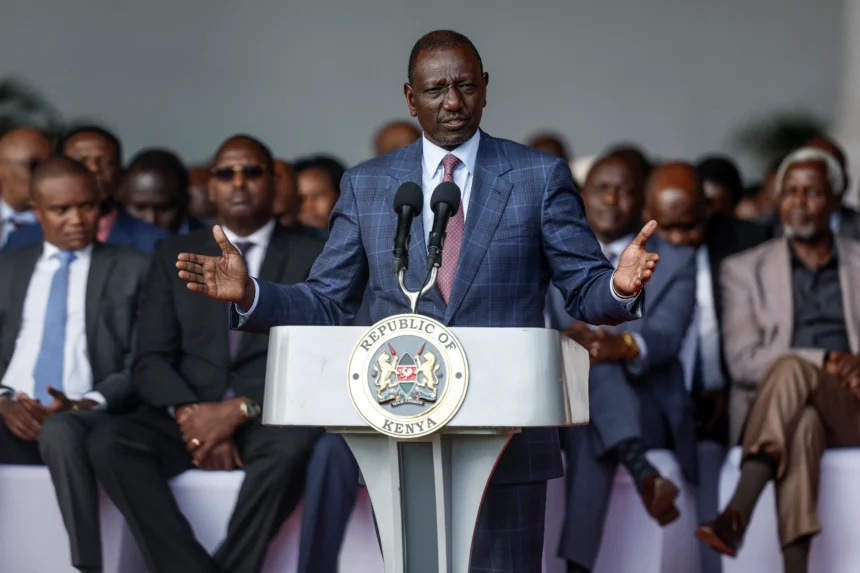

The legislation includes the Pay As You Go Regulations, 2024; The Income Tax (Employment Fund) and Income Tax (National Social Security Fund) (Exemption) Regulations 2024. This comes after President William Ruto had announced plans to re-introduce the Finance bill that was withdrawn following widespread protest in June.

The proposed regulations include the Tax Procedures (Distraint) Rules, 2024; the Income Tax (Leasing) Rules, 2024; the Income Tax (Registered Collective Investment Schemes) Rules, 2024; the Income Tax – Declarations of Crops; and the Income Tax – Prescribed Limit of Medical Benefit.

Following the provisions of the same Act, the Commissioner General, representing the Cabinet Secretary of the National Treasury and Economic Planning, extends an invitation to interested members of the public, professionals, and stakeholders to provide their feedback and comments for consideration in the finalization of the Rules, as stated in the notice.

- Advertisement -

Under the same law, the Prime Minister, on behalf of the Prime Minister, the Ministry of Finance and the Ministry of Economic Planning, invites stakeholders, experts and participants to present their thoughts and feelings in the decision-making process.

KRA has underscored its dedication to promoting public involvement in the development of tax policy, urging individuals, professionals, and stakeholders to examine the drafts and offer their insights.

This notice follows a previous one issued on June 24, 2024, where KRA advised taxpayers to update their details to support a data cleanup of personal identification numbers.