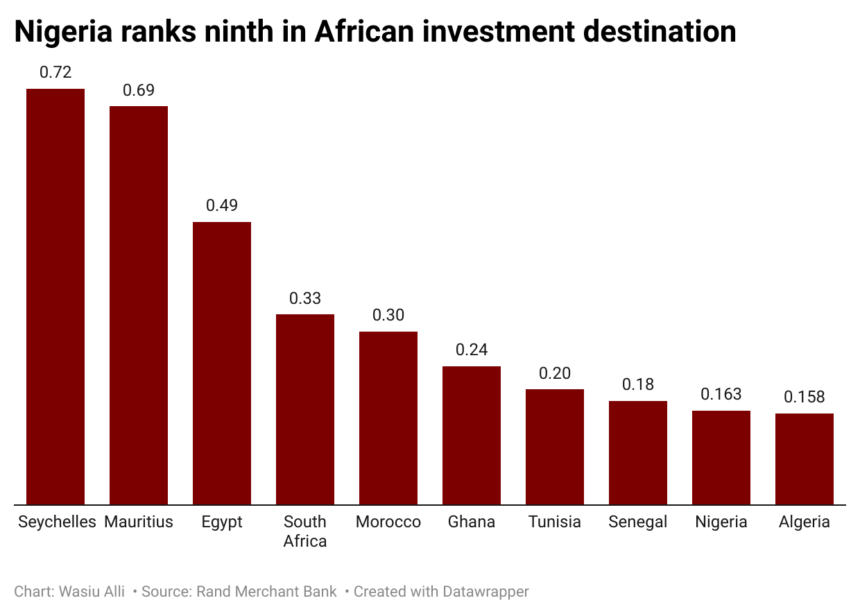

A Bloomberg report has ranked Nigeria ninth among top African investment destinations. This ranking was based on economic performance, market accessibility, investment climate, and social development of 31 African countries.

Despite facing political instability and infrastructural deficits challenges, the report considers Nigeria as a market emerging with significant growth potential.

At the top of the list are Seychelles and Mauritius. Although both countries have strong economic stability, investment climates, and social development indicators, their small economies and populations may, however, discourage investors. Egypt ranked third, appealing to investors with its vast market and strategic position.

To help investors understand the distinctive traits and possible opportunities within different markets, the report classified the 31 African countries into various groups.

- Advertisement -

Below is a more lucid explanation:

Highflyers – Nigeria, South Africa, Egypt, and Ethiopia – large, established economies.

Cleared for Take-off – Senegal and Côte d’Ivoire – countries with high growth and innovation potential.

People Potential – Kenya, Uganda – countries with young and growing demographics.

Global Connectors – Morocco, Seychelles – advanced economies with international presence.

- Advertisement -

Low-Base Boomers – Rwanda, Mozambique – smaller markets with high growth potential.

The report notes that factors such as geopolitical tensions and global inflation in African investment destinations have kept the cost of funding for African borrowers elevated.

Nigeria’s foreign investment environment has seen varied results. The total amount of foreign capital dropped by 27% to $3.91 billion in 2023. However, there was an increase in foreign investment in the first quarter of 2024, amounting to $3.37 billion, up 210.16% from the previous quarter.

With major sectors, including trading, banking, and telecommunications, drawing a lot of foreign investment, Nigeria’s economy shows promise.

In order to take full advantage of its potential, Nigeria must address its economic challenges, such as foreign exchange shortages and rising inflation, to improve its investment climate and drive economic growth.